Innovative Investment in Energy: Markets and Capital

Energy availability underpins economic growth

In the depths of the Great Depression, Standard Oil of California offered the king of Saudi Arabia an upfront payment of

$250,000 plus 10 cents per barrel in royalties for exploration rights to a newly discovered oil field. The company’s busi ness was hobbled by deeply depressed crude prices, but it possessed consider able capital and a long-term view. Further investment to develop the Saudi resources was put off for years, yet over time the returns would prove enormous.

As petroleum experiences another bear market, some investors are looking to deleverage, with projects backed by non investment-grade bonds among the first to act. That said, no sector rivals energy in its ability-and need- to project market fun damentals over long time periods. Looking ahead decades, demographic, geopolitical and technological factors foretell a rise in worldwide demand, which will require appropriate investment. Eirik Wc.erness,

Chief Economist at Statoil, notes a reciprocal cause-effect relationship between economic growth and energy’s fortunes.

“Economic development will continue to drive energy demand, and energy is a prereq u’isite for economic growth,” says Wc.emess. The current supply of natural gas and oil is meeting demand, but the world’s largest oil and gas fields are maturing. Statoil’s research group estimates that in 2040, fossil fuels will continue to supply over 70 percent of total primary energy demand.

To meet total energy demand in the

2030s will require capital outlays that are expected to be significantly higher than

the already-high amounts spent over the

past 15 years. “It’s a question of whether producers believe in sufficiently high prices for the product, and whether our cost of capital will be at a level that lets us meet the challenge,” comments Wc.erness.

The energy investment picture can be clouded-but also clarified-by politics and

public rhetoric. Social concern around C02 emissions has spurred calls for divestment of fossil-fuel equity by university endow

ment and state pension funds. However, in his recent story on the topic, Nathaniel Bullard of Bloomberg New Energy Finance (BNEF) notes that “very few other invest ments offer the scale, liquidity, growth and yield of these century-old businesses with economy-wide demand for their products.”

The BNEF report does note that coal could find itself increasingly pared from institutional portfolios. The report also points to renewables as a destination for capital. “The $5.5 trillion needed to build out clean energy through 2030 will offer many new opportunities for investors,” Bullard writes.

As it forecasts investment spending,

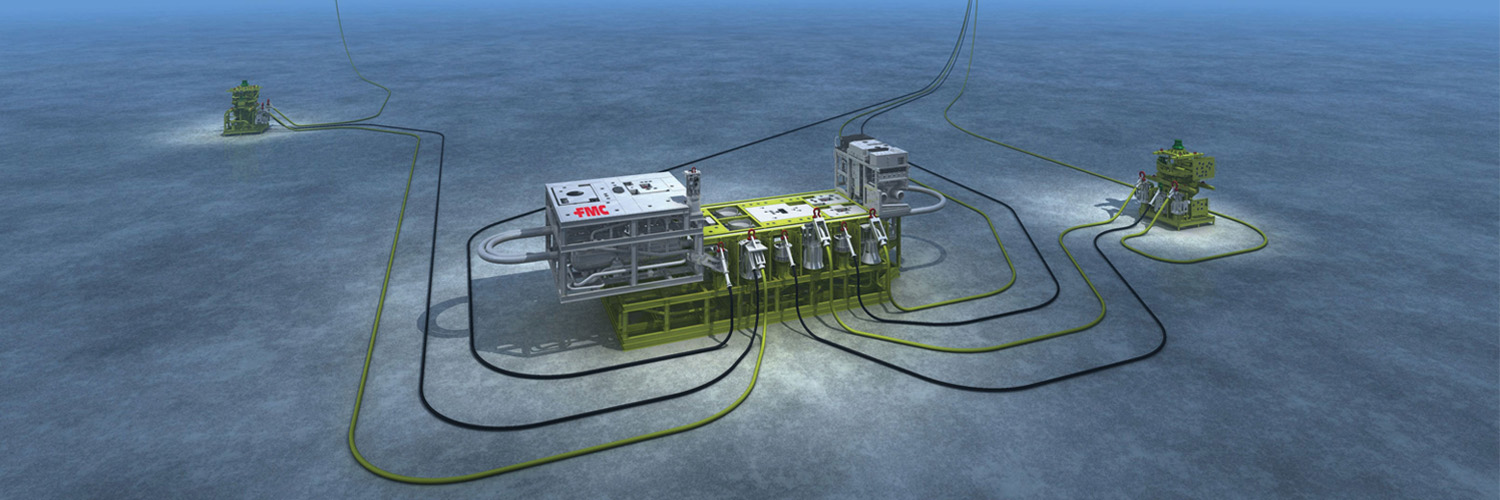

the energy industry now seeks efficiency in every possible facet, including sharing of geologic data and of ownership of licenses among multiple producers. “Collaboration is

a best practice we need to see more of,” says

Per Sandberg, Vice President of Innovation at Statoil. “In this business you must drill to get data, so without sharing there is duplica tion of that capital cost; better to have the competition be about data interpretation.”

Within the BNEF analyst group, Michel Di Capua, Head of Analysis, Americas Re gion, has looked at capital investment from the standpoint of R&D spending. “There has been appetite from the venture capital community for low-carbon renewables,

but that’s not to say that more-established

industries are standing still. In the world of natural gas, there have been tremendous advances in technologies to reinver]t the methods of extraction and production,” he says. “Implementing these innovations and scaling them calls for collaboration among industry, academia and investors.”

-David Gould

Recent Comments