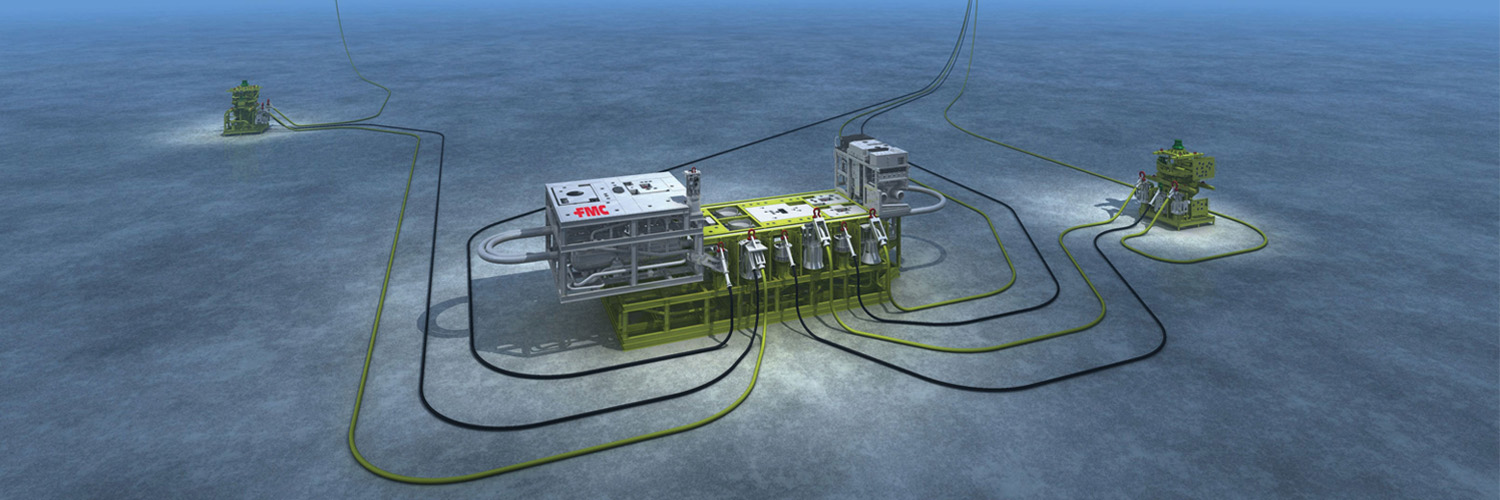

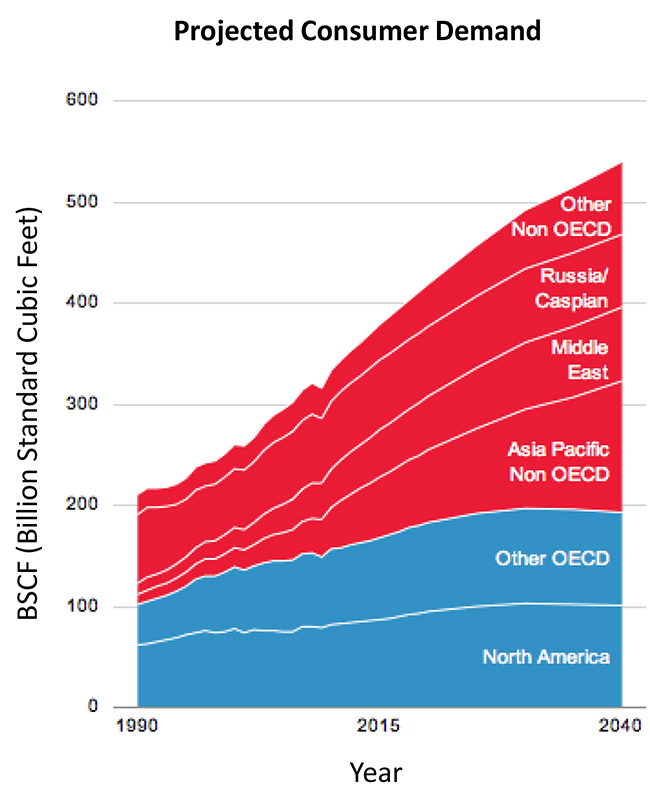

Fossil fuel usage is expected to grow 40% by the year 2030.1 Methane is the preferred fuel due lower air emissions: 30% less than oil and 43% less than coal.2 Present technologies for conversion of methane to LNG ( Liquified Natural Gas (cryogenic) ) and GTL ( Gas To Liquids ) and petrochemicals make methane a valuable product with global demand.

Recent US Department of Energy estimates show hydrate reserves to be 700,000 trillion SCF,3 having an estimated Hydrate value between $2,800 and $11,200 trillion based on current FMV.*4 Abundant supply may impact market price.

*The current price of methane is $4 to $6 and in Far East between $16 and $18 per million BTU

(1,000 SCF)

3, 4 – See Addendum Sources.

Cash flow could be generated by several methods, including:

- Royalties for use of technology: ~ 0.5% to 1% of total revenue

- Licensing arrangements

- Purchase of hydrate reserves that are presently dormant due to lack of a production technology

Recent Comments